Refinancing Tips for 2025: How to NavigateToday’s Mortgage Market

Is now the right time to refinance your mortgage?

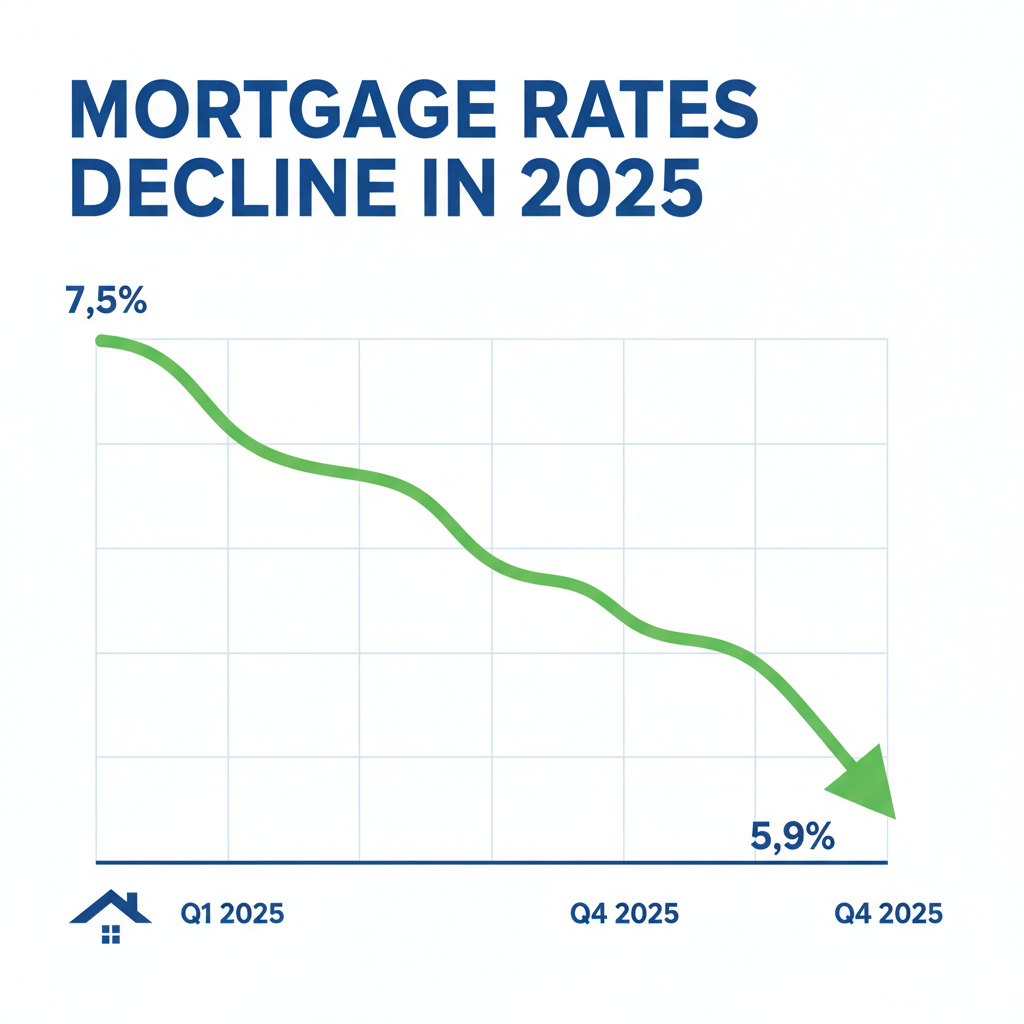

With 30-year mortgage rates hovering around 6.35%, the lowest in nearly a year, refinancingmightoffer considerable savings for homeowners with loans taken when rates were above 7–8%.By understanding when it makes sense to refinance, how to shop smart, and what to avoid, youcould save monthly—and over the lifetime of your loan.

Why Now Could Be the Time to Refinance

• Lower 30-year rates: As of mid-September 2025, the average rate for a 30-year fixed mortgage has dropped to 6.35%, its lowest in nearly a year.

• Federal Reserve outlook: Markets widely expect the Fed to cut its benchmark rates by0.25%at its September meeting, potentially leading to further movement in mortgage rates.

When Refinancing Makes Sense for You

You can lower your rate by at least 0.5%–1%.

If you currently have a rate above 7–8%, even a 0.5% reduction can save you thousands over time.

Check your “break-even point.”

Divide your closing costs by the monthly savings to estimate how long until the refinance pays off. Experts recommend refinancing only if that timeline is under 2–3 years.

Key Strategies to Maximize Benefits

Improve your credit score first.

A higher credit score—ideally 720+—can help you qualify for better rates. Always check your credit reports for errors and work to boost your score before applying.

Shop around.

Get quotes from at least three different lenders to compare both the interest rate and APR, which covers fees and closing costs.

Choose the right loan term:

o 15-year fixed: Higher monthly payments, steep interest savings.

o 30-year fixed: Lower payments, more interest over time.

o Cash-out refinance: Tap your equity for renovations, debt consolidation, or investments.

Current Market Opportunities

Rate-and-term refinances remain the most common—great for lowering your rate or adjusting your term.

Cash-out options are increasingly popular given strong property values in many areas.

Streamline refinances(FHA, VA, USDA) might be available with less paperwork.

No-closing-cost refinances can be a good option if you plan to move or refinance again in the near future—just remember they typically come with slightly higher rates.

What to Avoid

Waiting for “perfect timing.”

Rates may continue falling—but waiting too long can cost you. If meaningful savings are available now, it’s often better to act sooner.

Ignoring total costs.

Don’t just look at the rate—include closing costs, appraisal fees, and potential penalties.Even “no-closing-cost” offers can cost more down the road via higher interest.

Final Takeaway

You’re in a prime spot to benefit if you locked in your mortgage when rates were above 7–8%.With the 30-year average at 6.35%—and possibly dropping further due to expected Fed cuts—now is a strong moment to consider refinancing. Follow the simple tools of comparing quotes, evaluating costs, and matching terms to your financial goals.

Ready to explore your refinance options?

Call or email me today to schedule a personalized refinance analysis. Whether you want to save on your monthly payment, shorten your loan term, or tap into your home’s equity—let’s make sure you’re making the smartest move possible.